It's called the Waterfront Wonderland for a reason

Cape Coral has 400 miles of navigable canals and a looming property value problem. It must believe in magic.

This is a story about steadily shifting risk into places that may not ultimately be able to bear it, both at the state and federal level.

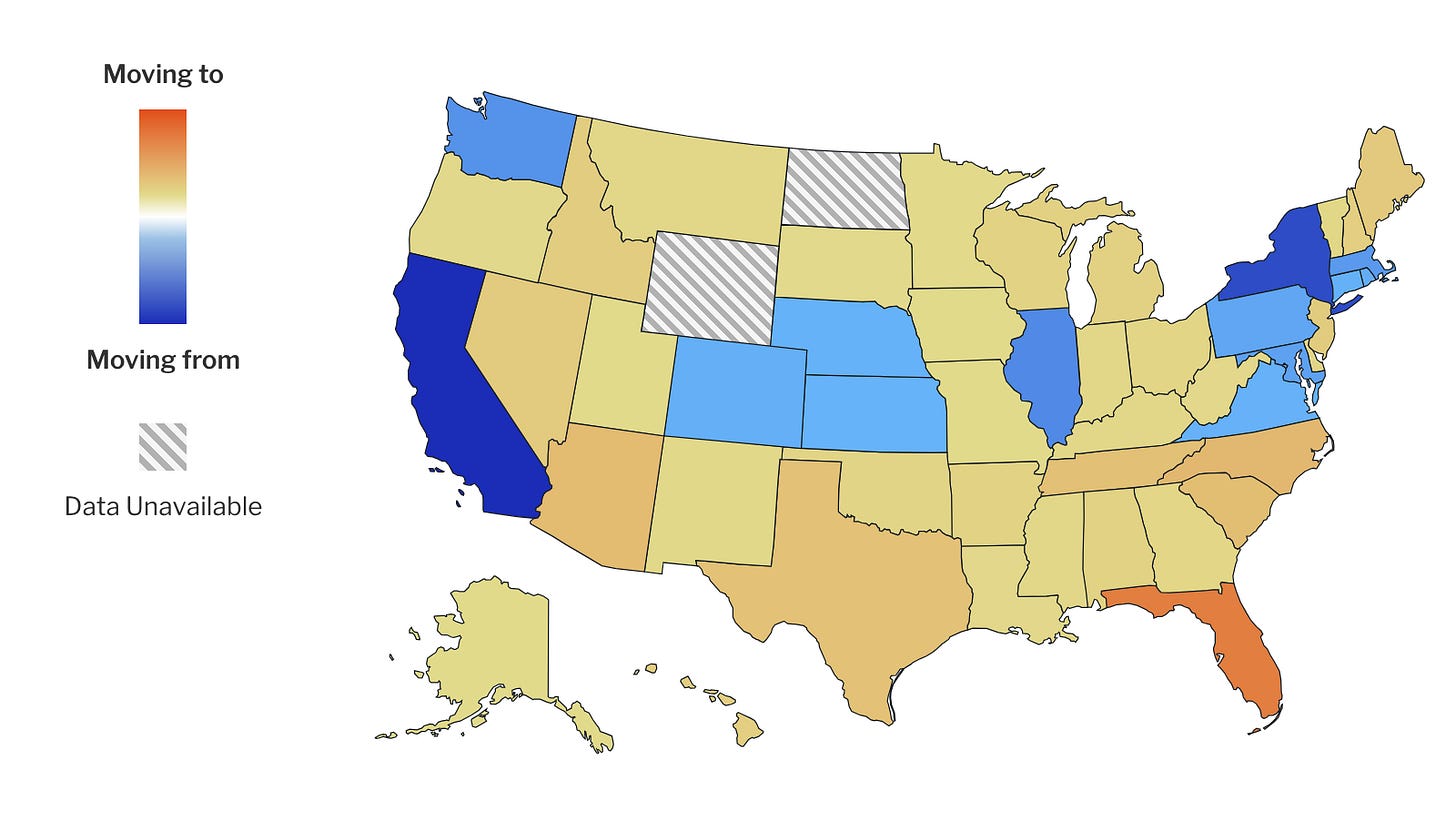

Would-be homeowners keep moving to Florida. Cape Coral, FL is the fourth most popular destination for people moving within the US, according to recent Redfin data (behind Sacramento, Phoenix, and Sarasota), and Florida is the most popular state.

I'm focusing on Cape Coral, because it was dug out of a swamp in the 1950s and created by developers. It is a place made of water. Here's the street map, for context

And here's the canal map.

Access to the Gulf of Mexico carries with it the risk that the Gulf may access your house when a storm or an extraordinary tide arrives, and heavy rainfall is a big problem. That's what happened in 2022 with Hurricane Ian. Earlier this month, the area was hit with an astonishing amount of rain.

Since I wrote in April about the fragility of Florida, several recent developments are combining to increase the pressure on the residential property market there.

The state insurer-of-last-resort is getting larger and charging more for the same slender coverage. Florida’s Citizens Property Insurance Company is continuing to balloon in size. It's now the largest insurer in the state, with 1.2 million policies and 18% market share, up from about 420,000 policies in 2019. Lee County is one of the places where Citizens sells the most coverage—about 30,000 policies:

Last week, Citizens announced that it would be raising its prices by about 14% starting next year. That will be painful for thousands of homeowners in Lee County.

Many more Floridians will have to buy federal flood insurance, and those rates are rising. Because of a bill the Florida legislature passed in 2022, every Citizens policyholder has to buy federal flood insurance—whether or not their property is in a flood zone or subject to a mortgage.

We know that takeup rates of federal flood insurance are very low. Something like 70 percent of homeowners in risky places don't buy this coverage, and even though Floridians are major customers of federal flood insurance (accounting for 1.7 million out of the 3.4 million policies issued nationwide), even when you add in private flood insurance just 20% of Florida's 10 million homeowners have flood coverage. So when these Citizens policyholders get their flood insurance bills, they won't be grandfathered in to older rates. Instead, they're going to get the new, actuarially sound rates that FEMA has been implementing since mid-2021. Which are high.

And some of these homeowners may be in precarious financial positions. Lee County local officials have been doing all they can to keep in place a 25% discount from those rates that they lost after Ian—when FEMA noticed that local officials weren't keeping track of repairs.* This increased cost of flood insurance amounts to a yearly bill of about $300. The mayor of Cape Coral, John Gunter, said at a city council meeting that FEMA's action could cause families "not to even be able to live in their homes because of the cost of premiums."

There's other recent news from Florida: FEMA recently re-did some of its maps, and added almost 89,000 homes in Broward County and about 45,000 more homes in Miami-Dade County to its floodplain assessments. Those homeowners will also have to buy flood insurance if they have a mortgage in place. (The new Lee County maps aren't out yet.)

So that's the Florida situation: the public insurer is the largest one around, and its total exposure (if it had to pay out all of its policies at once) has mounted to $517 billion. If it can't pay claims after a major disaster—after all, it collected just $4 billion in premiums for that exposure—it will assess already hurting Floridians for the shortfall.

Florida's insurance situation is precarious. So is the NFIP. Citizen's catastrophic exposure may lead to a call for a Federal bailout someday, which is why Sen. Whitehouse is investigating the situation.

At the same time, the federal flood insurance program (NFIP) is also in extremis. It has less than $4 billion in the bank (most of which is in its reserve fund) and actually lapsed for 13 hours on March 23 of this year before being reauthorized. It's been reauthorized 29 times since 2017, and has borrowed tens of billions of dollars from the Treasury to keep limping along.

When it lapses—if Congress doesn't act to keep it going yet again by September 30 of this year—borrowers won't be able to get flood insurance, so they won't be able to close, renew, or increase their bank loans (if those loans are guaranteed by the GSEs). And if the NFIP is then hit with a large clump of claims and isn't able to pay them, it will have lost its authority to borrow more money from the Treasury.

Even if the NFIP keeps going somehow, it's continuing to (effectively) encourage homeowners to live in risky floodplains. It won't "fix" the situation after a storm, because it pays out $250,000 per home at most.

When homeowners in Ft. Myers and Coral Gables decide it's gotten too expensive and they need to leave (perhaps for Asheville NC, 2200 feet up!), they may not be able to sell their houses at prices that will make them whole.

It may take a long chain of events to get there, but all this risk will likely end up in the hands of the nation—on the books of the GSEs if people walk away from their mortgage obligations, or more generally on taxpayers if these pockets of risk affect other financial engines. These insurance movements are just the first few paragraphs of a longer story.

*If the cost to repair a home following a storm is 50% or more of its market value, the structure is considered substantially damaged and has to be brought into compliance with current local floodplain management standards. There seemed to FEMA to be a lot of unpermitted, casual rebuilding going on in Lee County that wasn't ensuring that that compliance was happening. Lee County says it has provided documentation to FEMA, and hopes to hear back by July 10.